Instructions for Annual Reconciliation of Employee Earnings Tax - City of Philadelphia, Pennsylvania

This document was released by Department of Revenue - City of Philadelphia, Pennsylvania and contains official instructions for Annual Reconciliation of Employee Earnings Tax . The up-to-date fillable form is available for download through this link.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Department of Revenue - City of Philadelphia, Pennsylvania.

ADVERTISEMENT

Other Revision

Download Instructions for Annual Reconciliation of Employee Earnings Tax - City of Philadelphia, Pennsylvania

4.5 of 5 ( 22 votes )

1

2

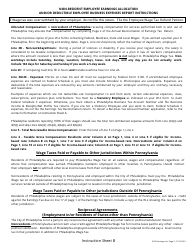

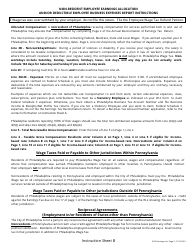

Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 1" width="950" height="1230" />

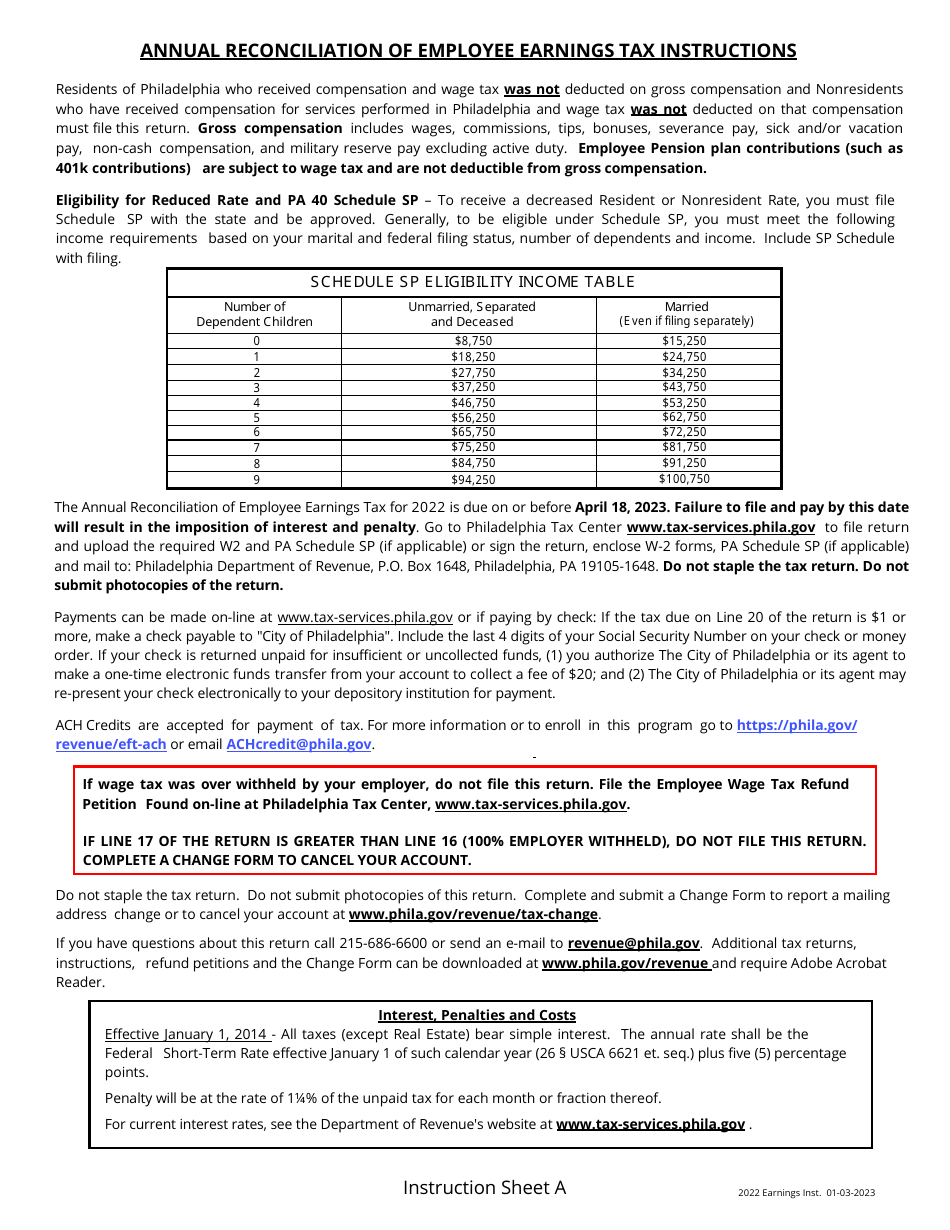

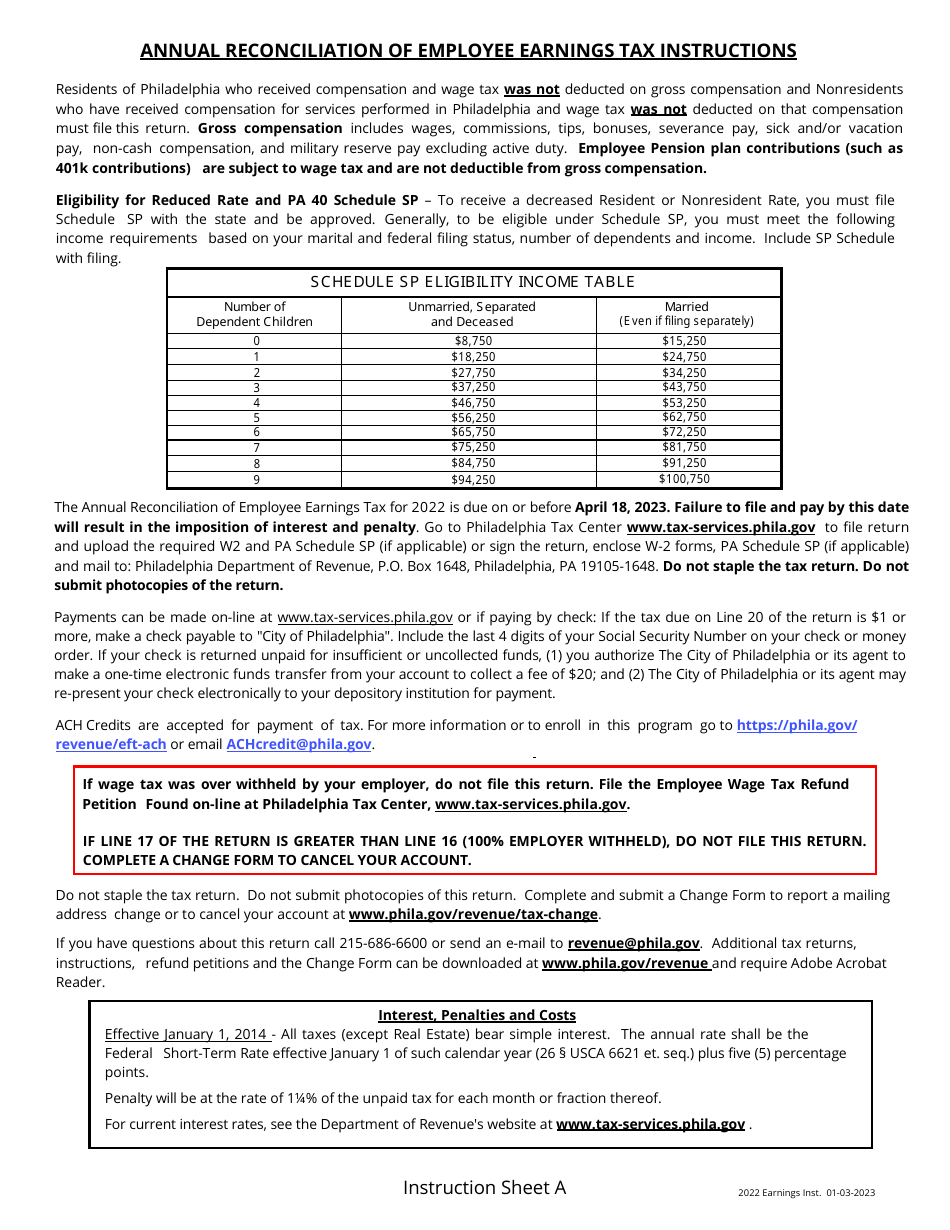

Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 1" width="950" height="1230" /> Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 2" />

Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 2" />

Prev 1 2 Next

ADVERTISEMENT

Linked Topics

Tax Season Payroll Tax Department of Revenue - City of Philadelphia, Pennsylvania Tax Requirements Tax Obligation Tax Preparer Free Tax Filing Tax Return Template Pennsylvania Legal Forms Legal United States Legal Forms

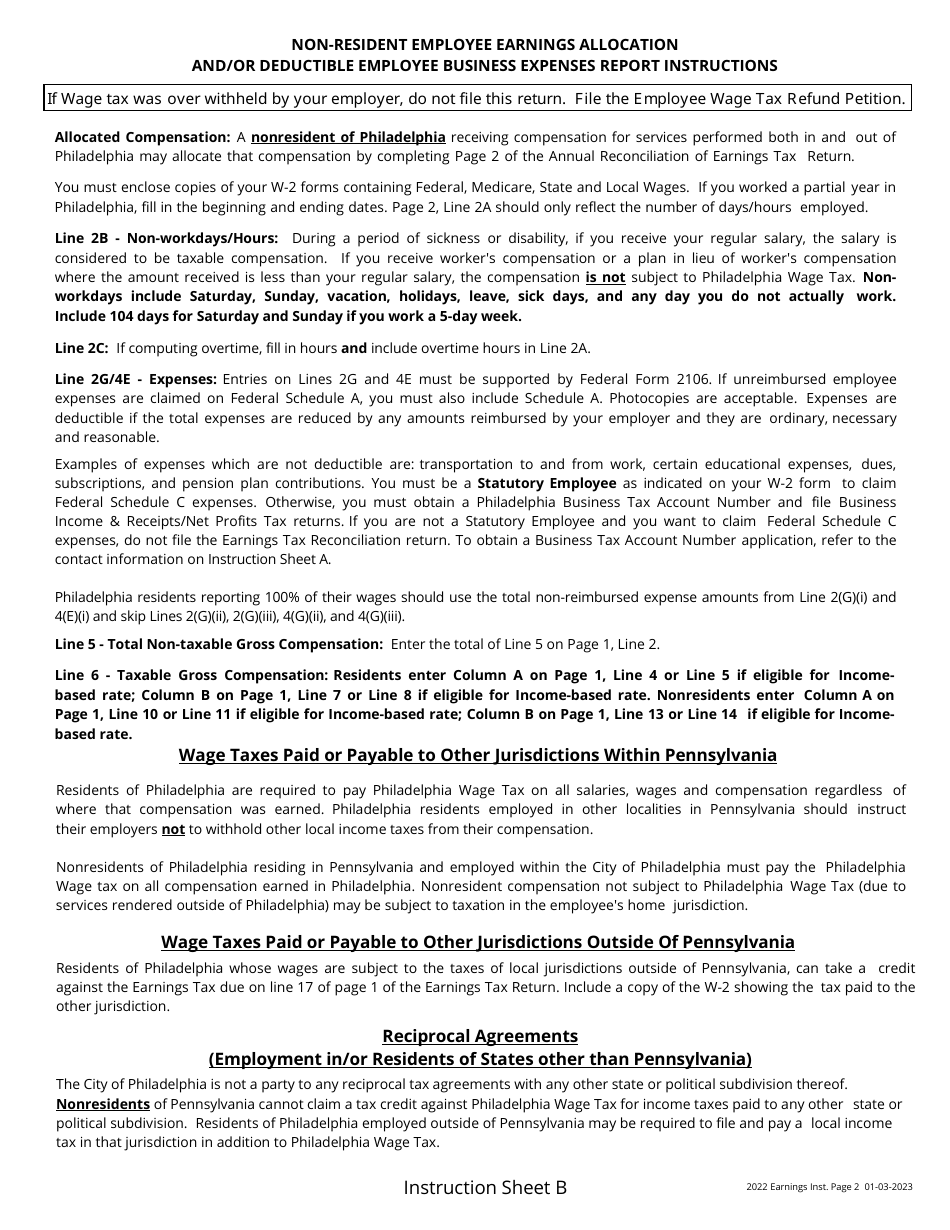

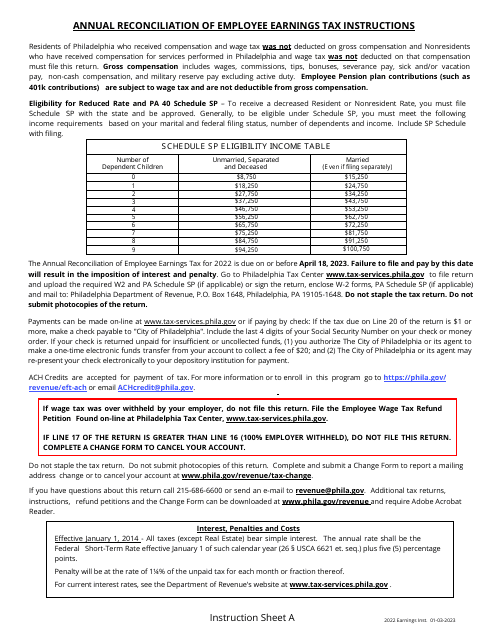

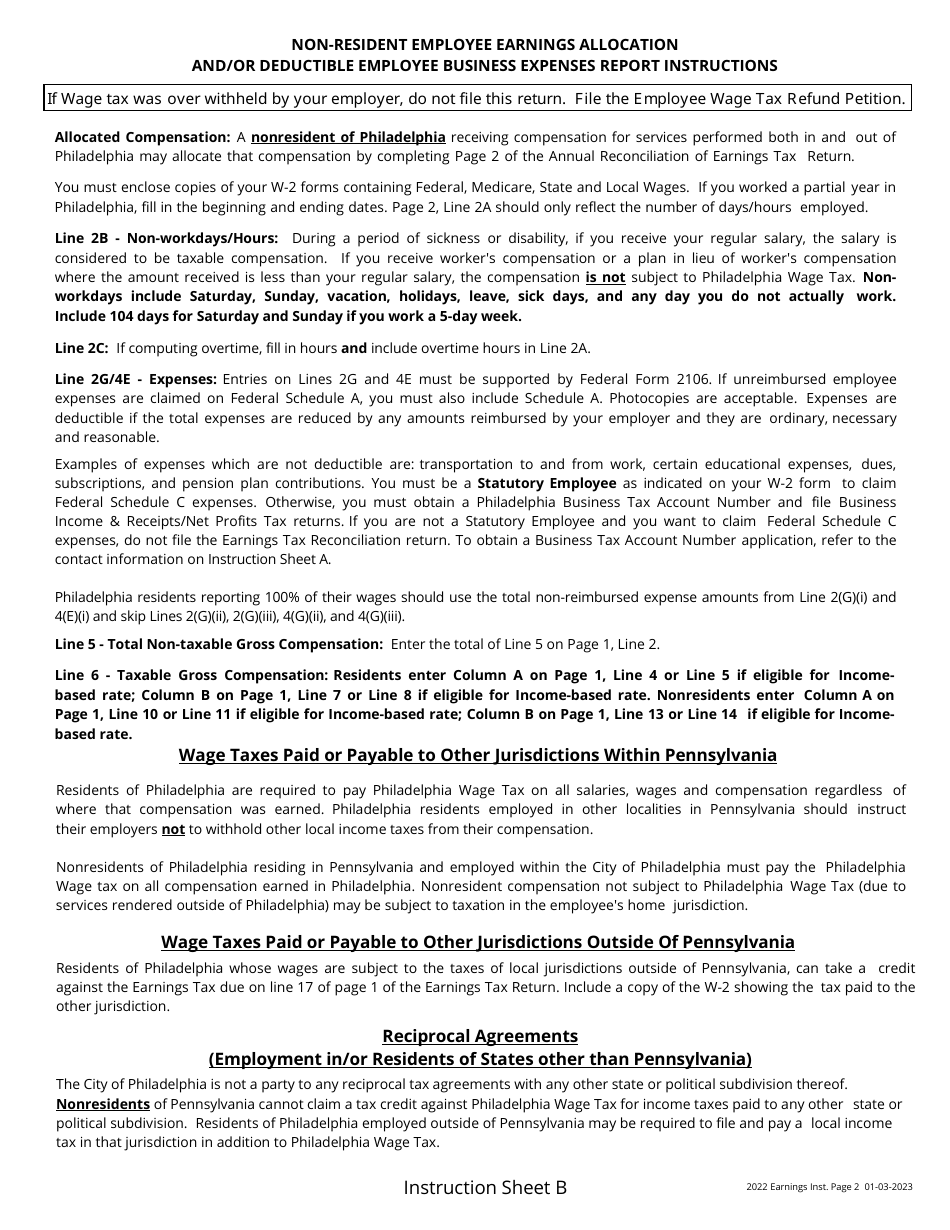

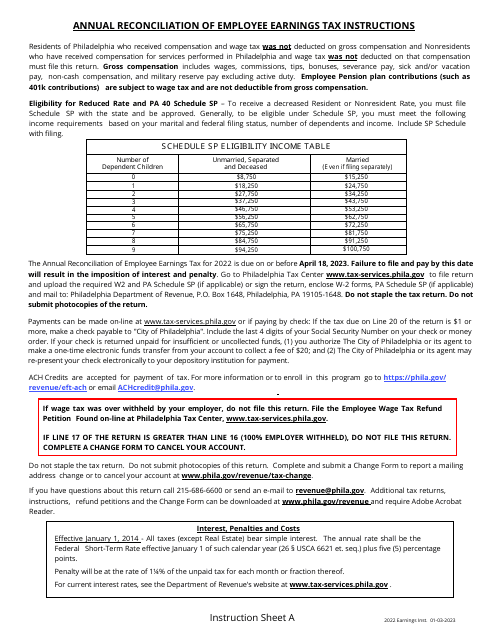

Employee Earnings Tax - City of Philadelphia, Pennsylvania Download Pdf" width="495" height="640" />

Employee Earnings Tax - City of Philadelphia, Pennsylvania Download Pdf" width="495" height="640" />

Related Documents

- Annual Reconciliation of Employee Earnings Tax - City of Philadelphia, Pennsylvania, 2023

- Form W2-R Annual Reconciliation of Earned Income Tax Withheld From Wages - Pennsylvania

- Form W-2R Annual Reconciliation of Earned Income Tax Withheld From Wages - Pennsylvania

- Form REV-1667 Annual Withholding Reconciliation Statement - Pennsylvania

- IRS Form 8916 Reconciliation of Schedule M-3 Taxable Income With Tax Return Taxable Income for Mixed Groups

- Form CLGS-32-2 Employer W2-r Annual Reconciliation of Local Earned Income Tax Withheld From Wages - Pennsylvania

- Form LST (W-3 LST) Annual Reconciliation of Lst (Local Services Tax) - City of Scranton, Pennsylvania, 2022

- IRS Form 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

- IRS Form 943 Employer's Annual Federal Tax Return for Agricultural Employees, 2023

- IRS Form 5471 Schedule E Income, War Profits, and Excess Profits Taxes Paid or Accrued

- Form REV-563 Business Trust Fund Taxes Responsible Party Information Form - Pennsylvania

- IRS Form 5471 Schedule P Previously Taxed Earnings and Profits of U.S. Shareholder of Certain Foreign Corporations

- IRS Form 965 Schedule B Deferred Foreign Income Corporation's Earnings and Profits (E&p)

- IRS Form 921-A Consent Fixing Period of Limitation on Assessment of Income and Profits Tax

- IRS Form 921-I Consent Fixing Period of Limitation on Assessment of Income and Profits Tax

- IRS Form 921-P Consent Fixing Period of Limitation on Assessment of Income and Profits Tax

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.

Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 1" width="950" height="1230" />

Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 1" width="950" height="1230" /> Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 2" />

Employee Earnings Tax - City of Philadelphia, Pennsylvania, Page 2" /> Employee Earnings Tax - City of Philadelphia, Pennsylvania Download Pdf" width="495" height="640" />

Employee Earnings Tax - City of Philadelphia, Pennsylvania Download Pdf" width="495" height="640" />